Rumored Buzz on Pvm Accounting

Table of ContentsPvm Accounting - QuestionsFacts About Pvm Accounting RevealedPvm Accounting - An Overview3 Simple Techniques For Pvm Accounting9 Simple Techniques For Pvm AccountingThe Ultimate Guide To Pvm Accounting4 Simple Techniques For Pvm Accounting

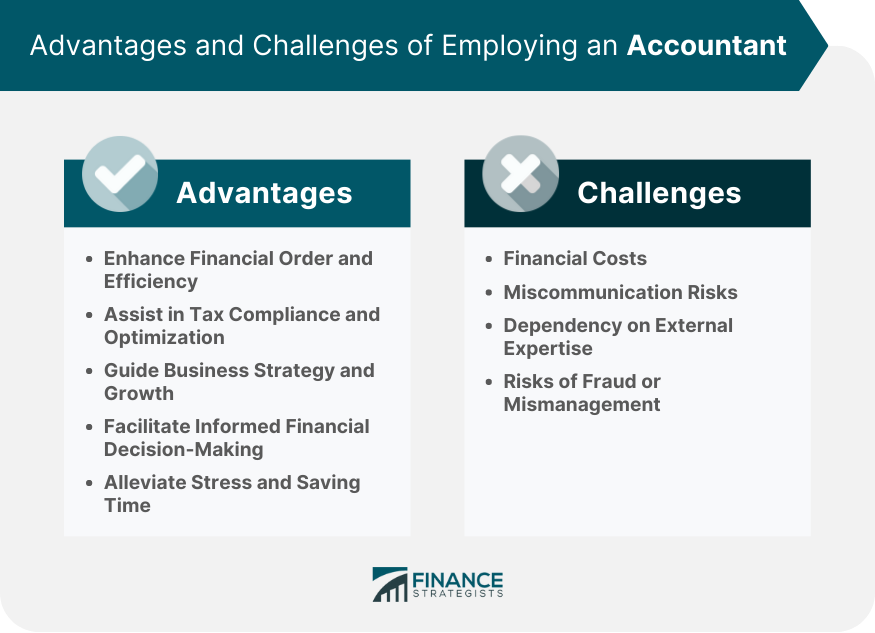

Is it time to work with an accountant? From enhancing your tax returns to analyzing financial resources for enhanced success, an accountant can make a huge distinction for your company.

This is a possibility to gain understanding into just how professional financial support can encourage your decision-making process and establish your organization on a trajectory of continued success. Depending on the size of your service, you may not require to hire an accountantat least, not a full time one. Many local business enlist the solutions of an accounting professional only during tax time.

Are spreadsheets taking over more and more of your time? Do you discover on your own irritated tracking down receipts for expenditures instead of focusing on work that's closer to your core mission?

Examine This Report about Pvm Accounting

An accountant, such as a cpa (CPA), has specialized knowledge in monetary administration and tax obligation conformity. They remain up to day with ever-changing laws and finest techniques, making certain that your company continues to be in conformity with lawful and regulatory requirements. Their expertise enables them to navigate complicated monetary matters and provide accurate reliable suggestions customized to your certain organization needs.

Do you regularly invest time on economic declaration prep work instead of working on company management? Funds can be time consuming, especially for tiny organization proprietors who are already juggling numerous responsibilities.

The Only Guide to Pvm Accounting

Accountants can deal with a selection of jobs, from bookkeeping and economic records to payroll handling, releasing up your routine. When it pertains to making financial choices, having an accountant's guidance can be incredibly valuable. They can provide economic analysis, circumstance modeling, and projecting, enabling you to evaluate the possible influence of numerous alternatives prior to deciding.

Pvm Accounting Can Be Fun For Anyone

For those who don't currently have an accounting professional, it may be difficult to recognize when to reach out to one. Every company is different, yet if you are dealing with difficulties in the adhering to locations, currently may be the ideal time to bring an accounting professional on board: You do not have to compose an organization plan alone.

This will assist you create an educated monetary strategy, and give you a lot more confidence in your economic decisions (construction bookkeeping). Which legal structure will you choose for your company.?.!? Working together with an accounting professional ensures that you'll make informed choices concerning your company's lawful structureincluding comprehending your choices and the benefits and drawbacks of each

Some Known Details About Pvm Accounting

Little service audit can come to be complicated if you don't know just how to handle it. The good news is, an accounting professional understands just how to track your financial resources in a variety of handy methods, consisting of: Establishing up accounting systems and organizing financial documents with aid from accountancy software application. Aiding with capital monitoring and giving insights right into income and costs.

Analyzing expenditures and suggesting ways to create and stick to budget plans. Offering analysis and reporting for educated decision making. This is likely the most typical reason that a tiny to midsize organization would certainly employ an accounting professional.

8 Easy Facts About Pvm Accounting Explained

By collaborating with an accounting professional, businesses can enhance their funding applications by providing a lot more exact monetary info and making a better situation for monetary feasibility. Accounting professionals can also assist with tasks such as preparing financial papers, assessing financial information to evaluate creditworthiness, and producing a comprehensive, well-structured finance proposition. When points alter in your service, you desire to make sure you have a solid take care of on your funds.

The Ultimate Guide To Pvm Accounting

Accounting professionals can help you establish your company's worth to help you protect a reasonable offer. If you choose you're all set for an accounting professional, there are a couple of straightforward steps you can take to make sure you locate the appropriate fit - https://www.avitop.com/cs/members/pvmaccount1ng.aspx.